Business Insurance in and around West Seneca

Get your West Seneca business covered, right here!

Helping insure businesses can be the neighborly thing to do

Insure The Business You've Built.

Running a small business is no joke. Insuring your venture should be the least of your worries. State Farm insures small businesses that fall under the umbrella of retailers, specialized professions, contractors and more!

Get your West Seneca business covered, right here!

Helping insure businesses can be the neighborly thing to do

Protect Your Future With State Farm

You are dedicated to your small business like State Farm is dedicated to great insurance. That's why it only makes sense to check out their coverage offerings for artisan and service contractors, surety and fidelity bonds or builders risk insurance.

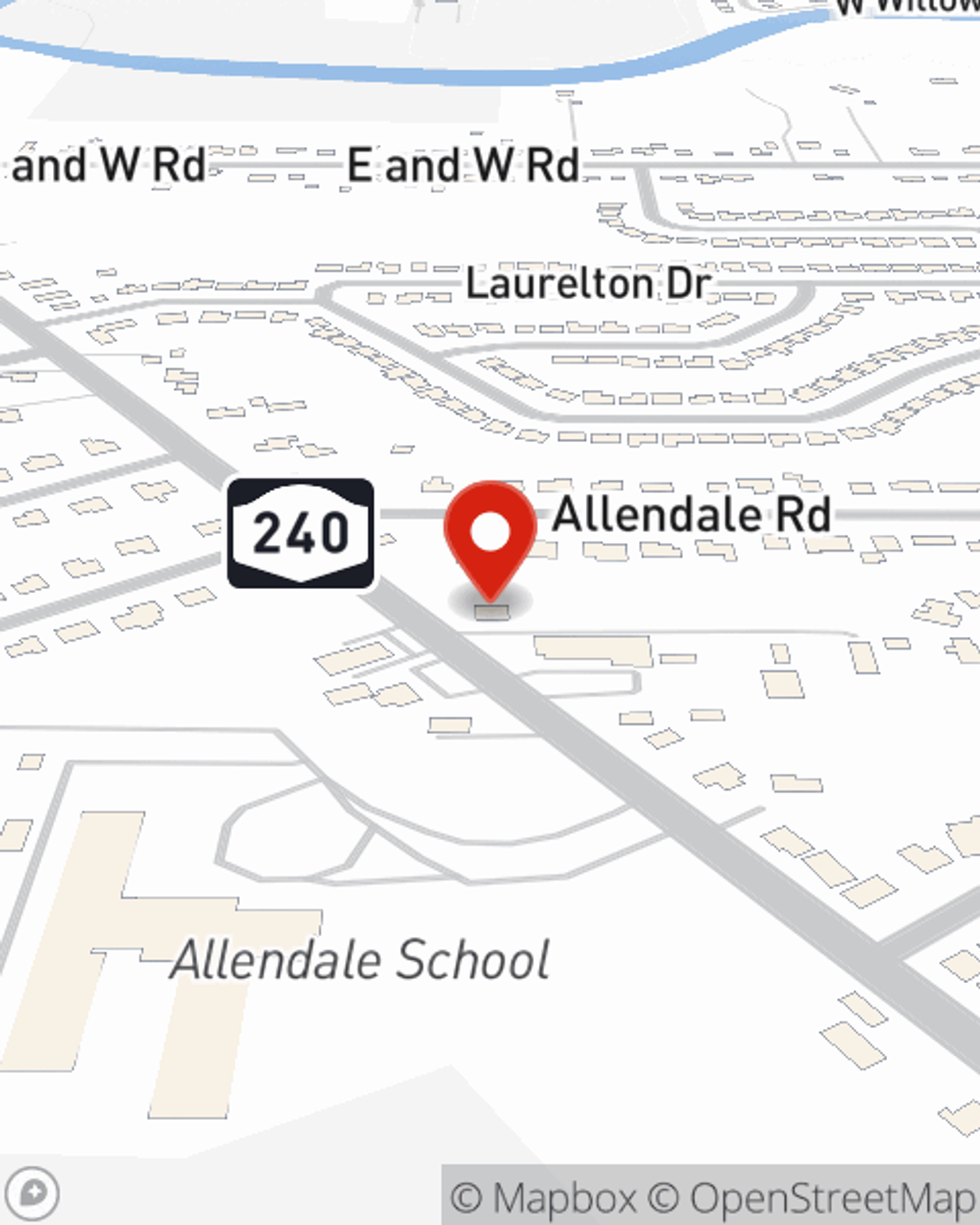

Since 1935, State Farm has helped small businesses manage risk. Get in touch with agent Mike Messuro's team to identify the options specifically available to you!

Simple Insights®

Tips to prevent employee theft

Tips to prevent employee theft

Employee theft can come in many different shapes and sizes. In the modern workplace, business owners are wise to have controls in place.

Protect your business property from slip and falls

Protect your business property from slip and falls

Decrease the chances of slips, trips and falls at your business with proper maintenance and safety procedures.

Mike Messuro

State Farm® Insurance AgentSimple Insights®

Tips to prevent employee theft

Tips to prevent employee theft

Employee theft can come in many different shapes and sizes. In the modern workplace, business owners are wise to have controls in place.

Protect your business property from slip and falls

Protect your business property from slip and falls

Decrease the chances of slips, trips and falls at your business with proper maintenance and safety procedures.